資産運用のご案内

資産運用のご案内

資産運用*1

お客さまの投資に対する考えをお伺いし、ご意向に基づいた資産の運用・管理をいたします。以下の6タイプをご用意しております。

積極的に増やしたい

(株式投資を中心とした運用)

All Equity

(株式 100% 債券 0%)

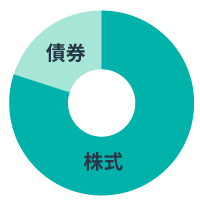

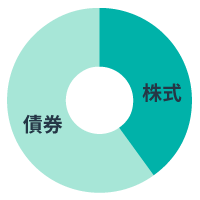

Growth

(株式 80% 債券 20%)

Balanced Growth

(株式 60% 債券 40%)

安定的に増やしたい

(アメリカ国債投資を中心とした運用)

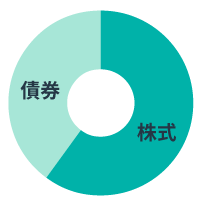

Balanced Income

(株式 40% 債券 60%)

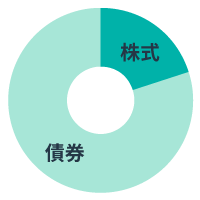

Income

(株式 20% 債券 80%)

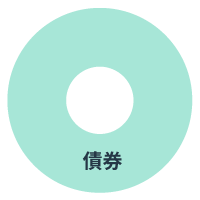

All Fixed Income

(株式 0% 債券 100%)

対象資産:500,000ドル以上

![]()

CPBの資産運用は、下記の方にもおすすめです

アメリカで保有している401K、IRA、ROTH IRA、投資口座等を移管したい

将来は日本に住む予定だが、資金は日本に近いハワイで保有したい

現在日本に居住しており、アメリカで保有している資金を1ヶ所でまとめて管理したい

アメリカの親族から相続した遺産を、そのままアメリカで保有したい

ソーシャルセキュリティ、アメリカの住所がないが、アメリカで運用がしたい

![]()

セントラル パシフィック バンクを選んでいただく魅力

日本語で丁寧にご対応・ご案内・お手伝い致します。

銀行だからこそ、安心・安定・安全にお客さまの大切な資産を守ります。

セントラル パシフィック バンクの口座と併用することで、貯める口座と使う口座を分けて管理ができます。

資産管理・継承

体力、判断能力の低下に備える

加齢に伴う体力の低下、認知症等の病気による判断能力の低下は免れません。また、手の込んだ金融犯罪や詐欺などから大切な資産を守る事は、体力・判断能力が低下した場合にはとても大変です。

セントラル パシフィック バンクでは、資産管理・資産継承のプロフェッショナルとして、お客さまの生活スタイルに寄り添った口座の管理をお引き受けいたします。

具体的なサービス内容の紹介

- エステートプランニングのご案内

- 不動産に関わる支払い代行

- 確定申告のお手伝い

など

このような方にお勧めします

| 具体例 | ご提供可能なサービス |

| 子どもがおらず、資金の管理を任せられる親族や友人も周りにいない。加齢により、今後、要介護状態の配偶者の老人ホームなどの支払いが心配。 | お客さまに代わって、お支払いが可能です。 |

| 資産を管理していた配偶者に先立たれ、困っている。認知症や病気になった場合に備えて、資産の管理をしてもらいたい。 | お客さまに代わって、資産の管理が可能です。 |

| いろいろなところで運用しているが、万が一に備え、ひとつにまとめて安定的に資産を管理したい。 | お客さまに代わって、資産の保全が可能です。 |

![]()

資産管理・資産継承のポイントとは?

| ポイント1 | お客さまが元気なうちにお支払い情報・今後のご意向をお伺いするため、万が一に備えて準備が可能です。 |

| ポイント2 | 定期的なお支払いや請求書など、お客さまに代わってお支払いが可能です。 |

| ポイント3 | 面倒なタックスリターン(米国での確定申告)などを、まとめてお引き受けすることが可能です。 |

| ポイント4 | お客さまの資産は、ご意向に基づき運用しながらお預かりいたします。 |

![]()

セントラル パシフィック バンクを選んでいただく魅力

日本語で丁寧にご対応・ご案内・お手伝い致します。

銀行だからこそ、安心・安定・安全にお客さまの資産を守ります。

口座管理のストレスから解放されます。

対象資産:500,000ドル以上(

相続に備える

生涯をかけて築き守ってきた大切な財産を、ご希望通りに次の世代、また社会貢献のために生かしていくためには、事前の準備が大切です。日本では遺言書による相続が一般的であるのに対し、アメリカではトラスト(信託)を作成し、遺族等に計画的に遺産を残すという手法があります。健康と判断能力が伴っているうちに遺産計画を立てる事は、相続発生後に残されたご家族の精神的・肉体的また金銭的な負担の緩和につながります。セントラル パシフィック バンクでは、資産管理・資産継承のプロフェッショナルとして、お客さまの想いを形にするサポートをいたします。

トラスト(信託)を作成することの利点

- プライバシーを守ることができます。

- 事前に財産の分配計画を立てることができます。

- プロベート(検認手続き)を回避でき、時間と費用が節約できます。

- ご意思が変われば、トラストはいつでも修正することが可能です。

- 連邦遺産税の免除(Basic Exclusion)を受けることが可能になります。

*ご夫婦共にアメリカ国籍保有の場合のみ

プロベートとは?

日本にはない相続手続きの一種です。遺産をいったん財団に入れた後、裁判所が任命した代表者がその遺言書の有効性をチェック、相続人を確定し、遺産から債務を精算したのち、申告納税などの遺産管理を行い、最終的に遺産の分配までを行います。

このような方にお勧めします

| 具体例 | ご提供可能なサービス |

| 自分の死後、子ども達に迷惑をかけず遺産を分配したい | お客さまの意志に基づいた分配が可能です。 |

| 自分の死後、特別な支援や配慮が必要な家族に代わって、遺産を守ってほしい。 | 特別な支援や配慮が必要なご家族に代わって、遺産の管理が可能です。 |

| 相続手続きは難しくてよくわからない。自分の死後、相続人のためにも、日本語でコミュニケーションを取りたい。 | 日本語でのお手続きが可能です。日本語でていねいにご説明いたします。 |

![]()

事前に相続に備えるポイントとは?

資産管理・資産承継のプロフェッショナルとして、お客さまお一人ひとりの大切な想いやレガシーを実現するための商品・サービスをご提供いたします。

| ポイント1 | お客さまが元気なうちにご意向をお伺いし、作成されたトラスト文書のお預かりが可能です。 |

| ポイント2 | お亡くなりになられた後のタックスリターン(米国での確定申告)、不動産売却などをまとめてお引き受けが可能です。 |

| ポイント3 | トラスト文書に基づき、責任を持って遺産分配をいたします。 |

![]()

セントラル パシフィック バンクを選んでいただく魅力

日本語で丁寧にご対応・ご案内・お手伝いします。

日系人によって創設された銀行です。相続人が日本にお住まいの場合でも、安心してお任せください。

銀行だからこそ、安心・安定・安全に資産を守り、お客さまの想いに基づいた確実な手続きを執行します。

必要に応じて、信頼できる専門家のご紹介が可能です。

対象資産:500,000ドル以上(

Stephen Corbisier

Senior Vice President and Director, Trust and Investments

Michiko Onnagan

Assistant Vice President and Sr. Trust Services Administrator

言語:英語・日本

お問い合わせ

資産運用や資産管理に興味をお持ちの方は、下記フォームにご記入ください。 当行担当者よりご連絡させていただきます。なお、ご連絡には数日を要する場合がありますので、ご了承ください。

資産運用や資産管理に興味をお持ちの方は、下記フォームにご記入ください。 当行担当者よりご連絡させていただきます。なお、ご連絡には数日を要する場合がありますので、ご了承ください。

*1 投資は、FDICまたはいかなる政府機関によっても保証されておらず、セントラル パシフィック バンクの預金または債務ではなく、またセントラル パシフィック バンクによって保証されているものでもなく、投資元本の損失を含む投資リスクの対象となります。